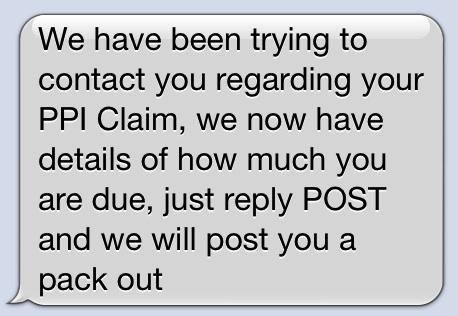

I was! Seriously fed up, calling all times of day or night, usually around the kids tea or bath time. Most. Annoying. Time. Ever. Oh and lets not forget the texts!

I would bet my mortgage I had never had a loan, credit cards yes for holidays but I know I never ticked PPI because I was working and that was just an extra cost and anyway I had a separate income protection policy. PPI was something for other people. I was not affected, definitely. STOP PHONING ME!

During the holidays I had to go into the bank to bank some cheques and I have no idea what made me ask this question, but I did and I am so glad I did!

- Me: These PPI claim calls, I get loads of them, can I get off the database?

- Girl in bank: You’re probably on the database because you have a claim.

- Me: I KNOW I don’t.

- Girl in bank: I can give you a list of all your accounts, cards, borrowings from here and the direct claim telephone number.

- Me: Erm, OK then

So I left the bank armed with print out of about 15 different account numbers, some I knew were my current account, old student bank accounts, saving accounts, some I had no idea what they were. I didn’t do anything with it at first because I knew I didn’t have a PPI claim because I hadn’t had any loans. It nagged me a bit, knowing I had the info and wasn’t doing anything with it so I picked up the phone and called the LloydsTSB claim line and made a claim for all 15 accounts! I have nothing to lose and then will have peace of mind to confidently hang up on all future callers!

Within ten days I got two letters back – one detailing 12 accounts which were not subject to PPI and the other detailing three accounts, dating back between 1999 and 2002, which did have insurance premiums applied. What? Really? Let me just check, did I not just bet my mortgage *gulp* that it wasn’t me? Those people getting the big payouts that was never going to be me. I know I didn’t take PPI out so if I have paid it then I didn’t knowingly pay it. The letter said they were investigating the claim, a few days later I had a phone call from the lady managing the case just wanted to know if I could recall taking out the policies, what they were for and whether I may have knowingly taken out the PPI. I cast my mind back to 1999 and I explained I was drunk I know I definitely did not take out PPI because I had income protection as I’d just bought my first property.

On Friday, so I would say less two months since I went into the bank and just happened to ask how to get off the PPI Claim database I received a letter on Friday from Lloyds TSB. Lloyds had completed their investigations, interestingly they no longer had any records for two of the accounts so have allocated the average claim amount for these policies, the third account they have details for payment returns everything I paid plus 8% interest.

To cut the chase I am received £5,294.00 – I am still in shock because it was so simple and straightforward to claim and PPI claims were for other people, right? Wrong! I still think, well I thought I hadn’t borrowed anything, clearly I was more drunk in my twenties than I remember! That is a serious amount of money and with Mr L and and I both self employed with Christmas and two children around the corner it makes a huge difference. So I write this post to say to you, even if you are like me and totally believe you aren’t affected, bearing in mind I would have bet my *cough* sizeable mortgage I wasn’t eligible for a claim or payout, still claim, its easy, the average payout is £1,200 so what have you got to lose? So, come on, what do you make of that then?!